|

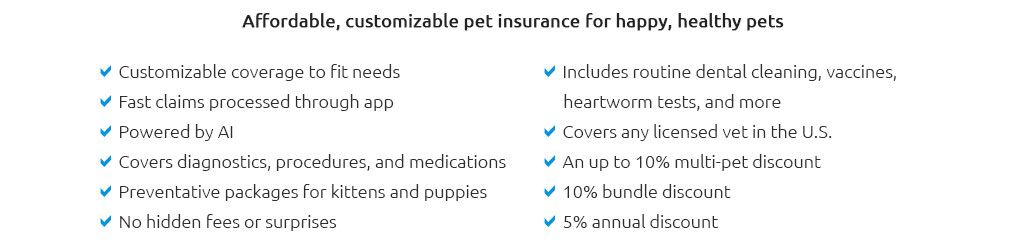

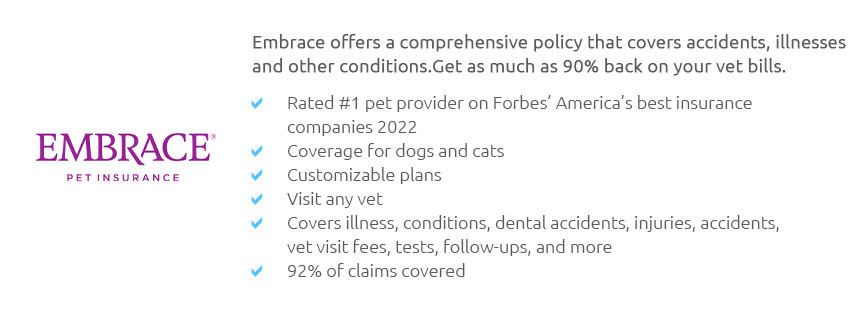

best rated dog pet insurance: a careful owner's comparison guideWhat "best rated" really meansStars look simple; the reality is layered. Independent reviews weigh claims approval speed, breadth of coverage, and how premium increases behave as your dog ages. Financial stability matters too, though a solid balance sheet doesn't guarantee painless claims. I'm confident a handful of carriers are consistently excellent, yet ratings can drift year to year, and that modest uncertainty is worth respecting. - Coverage strength: hereditary and congenital conditions, chronic illnesses, dental illness, exam fees.

- Claims experience: average days to pay, pre-authorization options, direct pay vs reimbursement.

- Policy structure: annual limit, per-condition caps, deductible type (annual vs per-incident), reimbursement %.

- Owner support: 24/7 help, clear exclusions, easy app.

How to compare quickly- Shortlist three top-rated plans from independent sources and your vet's experience.

- Confirm waiting periods, especially for cruciate and hip dysplasia; note any bilateral exclusions.

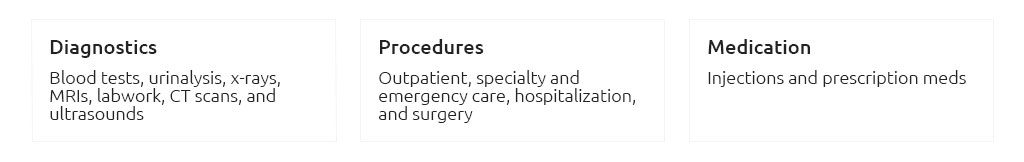

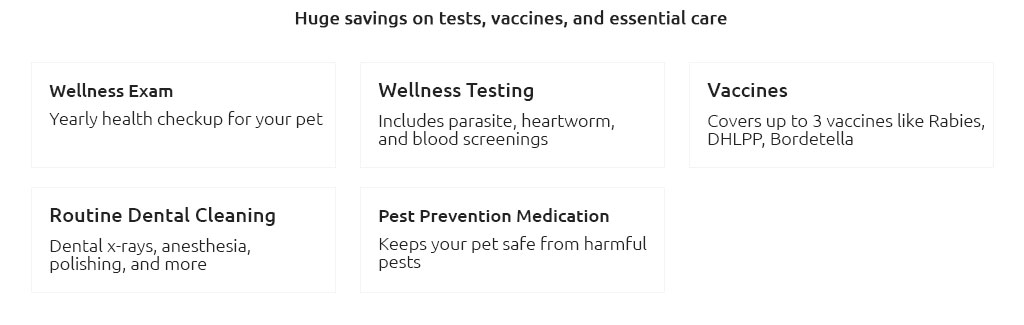

- Check what's covered: exam fees, prescription meds, rehab/PT, behavioral, dental illness, supplements.

- Choose an annual deductible you can pay in cash without stress.

- Prefer no lifetime or per-condition caps; prioritize annual limits you won't outgrow.

- Ask for sample policy; read exclusions and "pre-existing" definitions carefully.

- Estimate premium increases over time and whether coverage remains portable if you move.

Priority order for risk-averse owners- Exclusions clarity first. If terms are fuzzy, it's a pass.

- Major-claim protection next: high annual limit, solid reimbursement, fair deductibles.

- Claims track record over sign-up perks.

- Price last, but not ignored; pick sustainable costs you can keep paying at age 10+.

Cost vs benefit: a quick sketchSay a cruciate surgery is $4,500. With a $250 annual deductible and 80% reimbursement, your out-of-pocket is roughly $250 + 20% of $4,500 = $1,150. Without insurance, it's the full $4,500. If premiums are $55/month, that's $660/year. In a year with one big claim, insurance likely saves about $2,690; in a quiet year, you pay the premium for peace of mind. Over several years, results vary, but the downside protection is the point. Common gaps that surprise people- Bilateral clauses: one knee today, the other knee tomorrow - often excluded if pre-existing.

- Dental illness vs injury: fractures may be covered; periodontal disease often needs wellness add-ons.

- Exam fees: sometimes excluded unless you add the option.

- Waiting periods: accidents may start fast; orthopedic can take weeks or months.

- Chronic conditions: check if benefits reset annually without per-condition caps.

A small real-world momentMy neighbor's retriever, Maple, limped after a park sprint. The vet suspected a partial cruciate tear - x-rays, pain meds, rest. They filed through the insurer's app before dinner, uploaded the itemized invoice, and got reimbursement in six days. Not every claim moves that quickly, but the process felt humane during a stressful week. Reasonable options to explore- Plans with no per-condition caps and high annual limits.

- Insurers that allow direct pay to your vet for large procedures.

- Policies that include exam fees and rehab by default.

- Carriers with transparent orthopedic waiting-period waivers after a normal exam.

Nuanced notesPremiums generally rise as dogs age and vet costs inflate; mid-teens percentage bumps aren't unusual, though exact numbers vary. Claim approval rates look high in marketing, but methodology differs by source. I can't guarantee which plan will be "best" two years from now; I can say that prioritizing exclusions clarity and high-limit coverage has proven consistently sensible. Simple next steps- Gather your dog's records and a 12-month estimate of routine costs.

- Decide on a deductible you could pay tomorrow without anxiety.

- Get three quotes with the same limit, reimbursement, and deductible for fair comparison.

- Read each sample policy, highlighting exclusions; call support with three tough questions.

- Choose the plan that protects the big risks first and fits your long-term budget.

You're choosing resilience, not perfection. With a clear-eyed comparison and a bias for strong coverage, the best rated dog pet insurance becomes a practical safety net - not a gamble.

|

|